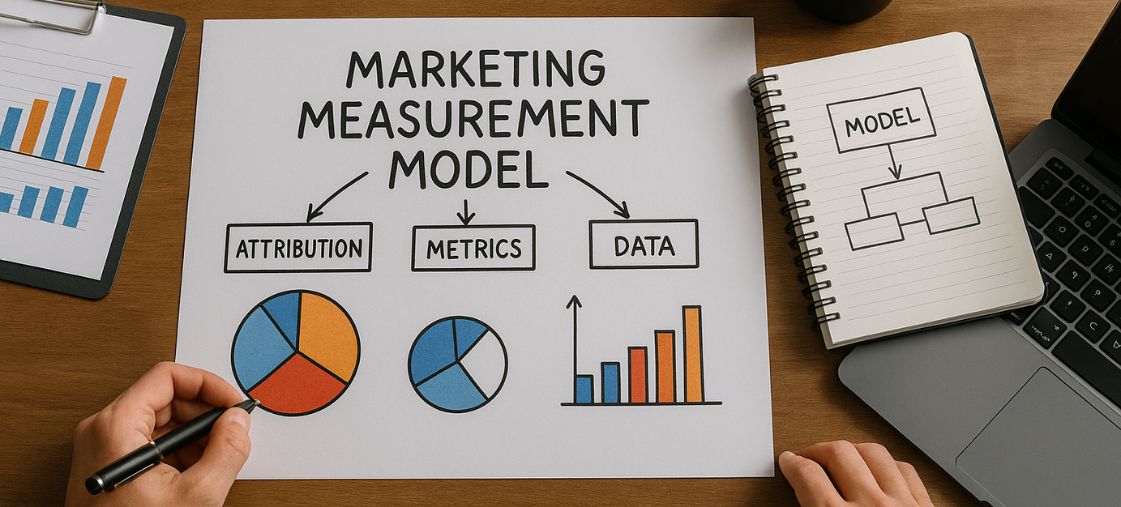

Building Marketing Measurement Models: A Practical Guide to Marketing Measurement Models

Marketing measurement models are the backbone of evidence-based growth, turning raw campaign data into actionable insights that improve ROI, budget allocation, and strategic focus. Whether you operate in a heavily digital environment or run complex omnichannel programs with offline media, a well-built measurement system gives you a repeatable way to tie marketing actions to business outcomes.

At their best, marketing measurement models do more than report; they guide decisions. The aim is to standardize how you define inputs (media, creative, audiences, pricing, promotions), control for confounders (seasonality, supply, competitive pressure), and quantify impact on outcomes (revenue, leads, profit, LTV). If you are new to the space, this marketing measurement primer offers a helpful foundation on terminology and common approaches.

There are three foundational pillars to consider: top-down, bottom-up, and experimental. Top-down methods such as Marketing Mix Modeling (MMM) use aggregate time-series data to estimate channel contribution and diminishing returns. Bottom-up methods like Multi-Touch Attribution (MTA) leverage user-level logs to assign fractional credit across touchpoints. Experiments (A/B, geo-lift, PSA tests) produce gold-standard causal estimates you can use to calibrate MMM and validate MTA. In practice, the strongest programs blend all three in a unified framework.

Modern teams increasingly augment these approaches with automation and AI—especially for feature generation, outlier detection, and budget optimization. If you want a broader context for how AI reshapes the stack and workflows, explore this perspective on the role of AI in marketing technology, including practical steps for adoption.

What “Good” Looks Like

A robust measurement program should deliver: (1) trustworthy estimates of incremental impact; (2) transparency into assumptions and uncertainty; (3) operational fit with planning cycles; and (4) prescriptive guidance you can act on (e.g., an always-current spend reallocation plan). To get there, align your analytics on business questions first, then pick the appropriate methods and data.

Step-by-Step Blueprint

1) Define decision-centric objectives

Start with the decisions your stakeholders must make: How much should we spend next month? Which channels deserve incremental budget? Which geos warrant expansion? Translate these into measurable outcomes and guardrails. Where possible, define a primary metric (e.g., revenue, LTV, or profit) and secondary diagnostics (e.g., CPA, CAC payback). Tie every modeling step to improving a specific decision.

- Revenue, profit, LTV, subscriptions

- Qualified leads, sales pipeline

- CPA, ROAS, CAC payback

- Conversion rate, AOV

- Budget ceilings, pacing

- Capacity, inventory limits

2) Audit data sources and create a unified schema

Catalog all inputs: ad platforms, web analytics, CRM, CDP, POS, call center, retail, pricing, promotions, and external signals (macro, seasonality, competitors, weather). Define a clean, documented schema for channels, campaigns, creative, formats, objectives, audiences, and geos. Create standardized, versioned transformations to ensure reproducibility. If your MMM uses weekly aggregates, decide how to roll up spend, impressions, clicks, reach, and baseline controls consistently.

3) Select the right methods for your questions

Use MMM for strategic planning and long-term efficiency curves; MTA for granular, journey-level insights; and experiments to validate both. For MMM, consider Bayesian hierarchical models for partial pooling across geos or products; for MTA, start with transparent, constrained Shapley or Markov-chain approaches before black-box models. Wherever possible, embed priors informed by experiments or domain knowledge to improve stability.

4) Engineer features that reflect marketing reality

Good MMMs encode how marketing actually works: adstock/lag structures, saturation (diminishing returns), seasonality, and baseline drivers. For MTA, capture touchpoint recency, frequency, sequencing, and cross-channel interactions. For both, bring in non-media levers such as pricing, promotions, and product availability. A well-specified feature set reduces misspecification and attribution leakage.

5) Train, validate, and quantify uncertainty

Split time-series or user-level data in ways that respect temporal ordering and campaign cycles. For MMM, evaluate in-sample fit, out-of-sample forecasts, and backtests around known shocks (e.g., a campaign pause). For MTA, test stability across cohorts and time windows. Always report uncertainty (credible intervals, bootstraps), and monitor how sensitive recommendations are to modeling choices.

6) Calibrate with experiments

Where possible, run geo-lift or holdout tests to measure incremental impact directly. Use these causal anchors to calibrate MMM elasticities or MTA credit weights. Over time, maintain a rolling cadence of experiments so that your models have fresh ground truth to learn from.

7) Translate results into budgets and plans

The end product of measurement is not a chart—it’s a plan. Build response curves (spend → outcome) and simulate multiple budget scenarios under constraints. Surface a recommended spend by channel/geo, the marginal ROI of the next dollar, and the expected range of results. Then capture reality by comparing plan vs. actuals and feeding that back into the models.

8) Operationalize: versioning, SLAs, and governance

Codify data pipelines, model training jobs, and dashboards. Version datasets and models. Define SLAs for refresh frequency (e.g., MMM monthly, weekly in high-velocity businesses; MTA daily), exception handling, and stakeholder communications. Establish governance for methodology changes and document every assumption in plain language.

Technical Considerations That Move the Needle

Adstock and saturation

Adstock models carry over the effect of a spend burst across future periods; saturation curves model diminishing returns. Together, these encode realism: the tenth dollar in a channel rarely performs like the first. Calibrating these curves well is the difference between plausible and prescriptive MMMs.

Baselines and confounders

Differentiate between what marketing influences and what it does not. Seasonality, macroeconomic shifts, inventory, and competitor activity often drive the baseline. Without explicit controls, models will incorrectly attribute baseline variance to your media.

Granularity and pooling

Decide whether to model at the level of channel, campaign, or geo. Hierarchical structures can “borrow strength” where data is sparse while preserving local signals. The tradeoff: granularity increases explainability but risks overfitting without sufficient observations.

Privacy and identity changes

MTA faces ongoing headwinds from signal loss. Lean more on experiments and MMM for robustness, and use modeled conversions cautiously. When using platform-reported conversions, treat them as inputs with uncertainty, not ground truth.

Example: From Zero to a Working MMM

- Frame decisions: Annual budget split across Paid Social, Search, Display, and TV to maximize profit within a cap.

- Assemble data: 130 weeks of spend, impressions, reach, CTR, and conversions; macro indicators; seasonality dummies; promotional calendar.

- Engineer features: Adstock for each channel, log-transformed spend, saturation via Hill or logistic curves, holiday/week-of-year effects.

- Train and validate: Fit a Bayesian MMM with priors on adstock decay and saturation steepness; evaluate out-of-sample forecast accuracy and elasticity plausibility.

- Calibrate: Run a 6-week geo-lift test on Paid Social to anchor elasticities; update priors accordingly.

- Optimize budgets: Use response curves to recommend a spend reallocation that lifts profit 8–12% at the same budget.

- Governance: Publish a documentation pack: data schema, assumptions, uncertainty ranges, and change log. Set a monthly refresh cadence.

Common Pitfalls and How to Avoid Them

- Metric drift: Unannounced changes to KPI definitions break comparability. Lock definitions and version them.

- Attribution leakage: Ignoring promotions, pricing, or product constraints biases results. Model the full demand system.

- Overfitting: Too many degrees of freedom with too little data. Prefer simpler, interpretable models with strong validation.

- Static playbooks: A one-time MMM becomes stale quickly. Treat measurement as a product with a roadmap, not a project.

- Actionability gap: Insights that don’t map to decisions won’t change outcomes. Design deliverables around planning cycles.

Making It Operational

Create a simple “runbook” for each monthly cycle: refresh data, retrain, re-validate against experiments, regenerate response curves, and propose budget moves. Track adoption: how often stakeholders follow recommendations, and with what results. Over time, link bonus or incentive plans to using the measurement system—nothing boosts adoption like aligned incentives.

What to show in your dashboard

- Marginal ROI by channel at current and proposed spend

- Expected range of outcomes with 80–95% intervals

- Scenario comparisons (status quo vs. reallocation)

- Elasticities and their credible intervals

- Experiment results and calibration status

Skills and Team Structure

High-performing teams pair marketing strategists with data scientists and analytics engineers. Strategists provide context on creative, audience, and market mechanics; data scientists design models; analytics engineers build reliable pipelines and deploy tools into the planning workflow. Assign a product manager to measurement so that backlogs, QA, and stakeholder needs are prioritised.

From Insights to Action

Use response curves to answer four practical questions: (1) Where is the next best dollar? (2) What is the cost of under-spending a channel? (3) What is the risk-adjusted range of outcomes? (4) Which markets deserve incremental tests? Close the loop by measuring realized impact vs. the model’s forecast and adjusting priors.

Conclusion

Marketing measurement models become a competitive advantage when they’re decision-centric, transparent, and continuously calibrated by experiments. Start with the decisions you need to make, build a reliable data foundation, choose methods that fit your questions, and operationalize the output so recommendations turn into action. For competitive intelligence on creative and placement strategies as you scale, tools like Anstrex can complement your models with market-level insights. The payoff for this rigor is compounding: better planning this quarter, better priors next quarter, and a learning system that keeps driving incremental growth.